Regulator revives plan to limit early pension withdrawals to 30 per cent before age 50

Kenya also faces low pension coverage, with over 70 per cent of workers retiring without a pension beyond payouts from the National Social Security Fund (NSSF).

Kenya’s retirement savings regulator has revived plans to curb early access to pensions, proposing stricter limits to help workers preserve funds for later years.

The Retirement Benefits Authority (RBA) says workers could be restricted to accessing only 30 per cent of their accrued benefits before age 50, aiming to curb the growing trend of premature withdrawals.

More To Read

- Why employers who fail to remit statutory deductions could face criminal charges

- Retirement Benefits Authority under fire over delayed pension payments to retired staff

- Fraud drains Kenya’s pension and health insurance funds, citizens left struggling

- Kenya's voluntary NSSF contributions drop by 47 per cent to Sh1 billion

- State agencies owe Sh6 billion in unpaid statutory deductions, Treasury warns

- Teachers who resigned or were dismissed after April 2018 eligible for pension, says TSC

The regulator was forced to shelve a similar plan earlier this year after public opposition, particularly from younger workers who argued that strict restrictions would limit financial flexibility. Currently, workers can access their individual contributions and up to half of their employer’s contribution before age 50, giving them access to as much as 75 per cent of their total savings.

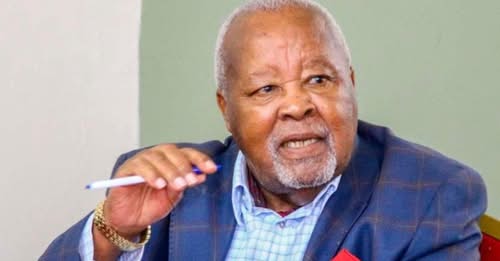

“There is a proposal that early access of retirement benefits before retirement be progressively limited to 30 per cent of accrued benefits,” RBA chief executive officer Charles Machira said in a presentation to stakeholders.

“One of our resolutions last year was to develop strategies to discourage early benefit withdrawals before retirement age.”

The proposal is based on data showing inadequate pension savings, especially among older workers. Figures from the Kenya National Bureau of Statistics (KNBS) indicate that 708,902 of 869,338 persons above the age of 60 are still in active employment, representing 81.5 per cent of senior citizens in the country. The data points to a potential deepening of old-age poverty, a concern in a society where traditional family support for the elderly has weakened.

Kenya also faces low pension coverage, with over 70 per cent of workers retiring without a pension beyond payouts from the National Social Security Fund (NSSF).

The RBA’s push to limit early withdrawals had previously triggered debate. Young workers opposed the proposal during public participation sessions in April, citing urgent financial needs such as buying a home, while older workers largely supported the curbs.

The regulator noted that the COVID-19 pandemic, which caused widespread layoffs, had increased the number of contributors accessing their retirement savings before the legal early withdrawal age of 50.

Following the opposition, the RBA indicated it would seek a compromise, allowing workers to access part of their contributions for pressing needs, including school fees, medical bills and mortgage payments, while still preserving the bulk of retirement savings.

Top Stories Today